In Boulder, Colorado, Democratic State Rep. Judy Amabile says people are having difficulty finding affordable home insurance. “It seems like across broad areas certain companies have decided we are not going to insure in this area,” she told 9News-TV. “They are having to make a lot of calls and the prices have gone up a lot and they are having difficulty finding anything.”

Amabile plans to introduce legislation to create a “last-resort” insurance plan provided by the state of Colorado. “The plans on that program are going to be really bare-bones and they are going to be very expensive.” She said at least 30 other states now have last-resort homeowners’ insurance programs like this, as more companies are increasing rates or even refusing to insure wildland/interface homeowners at all.

“Across the board, we are seeing 20 to up to 50 percent increases in renewals,” said independent insurance agent Morgan Lloyd.

Homeowners have moved into and built homes in wildland/urban interface areas for decades with little regard for the multiplying fire risk (and evacuation dangers) posed by increased development and neglected fire-safety mitigation. In some areas of the West, homeowners (along with homeowners’ associations, insurance companies, and local governments) are now facing the realities of paying for this development. NBC Los Angeles reported that more and more homeowners in southern California are being dropped by insurance companies because of wildfire risk. They talked with homeowners near Pomona whose insurance companies canceled their policies even though no wildfires have burned near their homes for years. Others’ premiums increased by 800 percent.

The Insurance Journal reported last month that California, Florida, and Texas are the states with the highest number of homes at risk of wildfire, but that other states also are faced with large and increasing risk. Colorado and New Mexico, for example, have fewer homes overall, but project fires can wreak tragedy on a much larger proportion of their populations. New Mexico’s Santa Fe County counts nearly 34,000 properties at risk of wildfire, but the county housed a population of only 155,000 in 2020. This ratio of vulnerable homes to the overall population underscores the magnitude of population displacement assistance, reconstruction resources, and economic recovery expense required after a major wildfire.

With wildfire danger threatening the liquidity and solvency of insurers, the California Department of Insurance has proposed new regulations to incentivize risk reduction on covered properties and neighborhoods. In October, the state Insurance Department issued regulations to recognize and reward wildfire safety and mitigation efforts by homeowners and businesses. The InsuranceNewsNet reported that California’s “Mitigation in rating plans and wildfire risk models” regulation is the first in the nation requiring insurance companies to provide homeowner discounts under the “Safer from Wildfires framework,” which the California Department of Insurance and state emergency preparedness agencies created last year. The regulation requires insurance companies to submit new rate filings incorporating wildfire safety standards. The new rates must recognize the benefit of safety measures such as upgraded roofs and windows, defensible space, and community programs such as Firewise USA and the Fire Risk Reduction Community designation developed by CAL-FIRE.

::: UPDATE: Highway to the Danger Zone :::

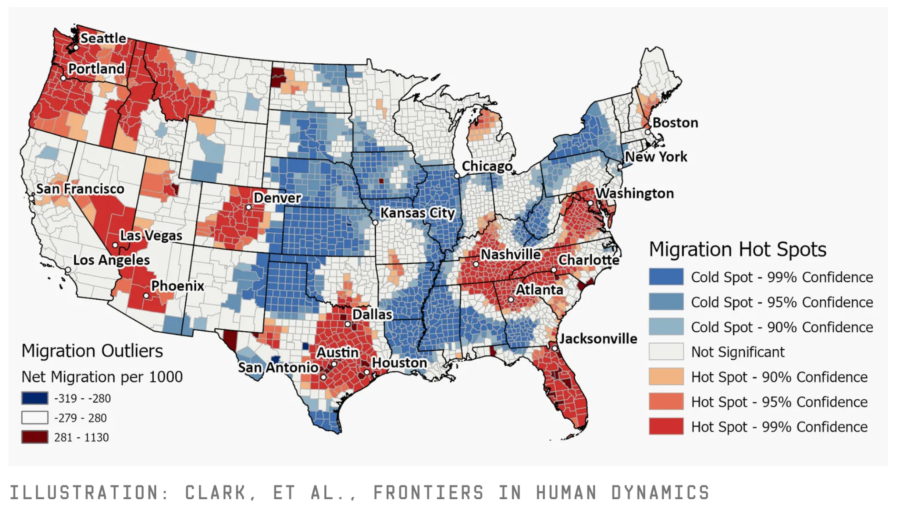

Matt Simon recently wrote an eye-opening piece for WIRED about a study examining numbers of residents moving into and out of fire danger zones (and hurricane regions) across the country. Wildfires in the West have grown increasingly devastating in part because of climate change, but also because more humans are moving deeper into areas that once were intact or contiguous forests. That overlap between development and wildlands, Simon noted, now exposes more people to fires and provides more opportunities to ignite them.

Americans are “flocking to fire,” say the authors of a study published last month in the journal Frontiers in Human Dynamics. Using census data, the researchers found that people are increasingly moving to areas that are more prone to catastrophic wildfires or plagued by extreme heat. And though some affluent Americans are seeking the beauty of forested areas, economic pressures are forcing others there, too: Skyrocketing housing prices and cost of living are pushing people toward more rural places where homes are cheaper.

“As temperatures increase — as things get drier and hotter and prices for housing get more unaffordable — it’s definitely going to push people into these rural areas,” says Kaitlyn Trudeau, a data analyst at the nonprofit Climate Central. “Some people don’t have a choice.”

Increases in the number of people living in wildfire zones come at a huge cost: the 2018 Camp Fire that destroyed Paradise, California, resulted in an estimated $16.5 billion in losses.

As a nonprofessional who has done incidental research, I know that

“Wildland/urban interface” is a technical term. Most people have no idea what they are getting into. In Marin County, CA, if you want to buy a house in the WUI, you find out what it means very quickly. And, once you’re in (with your sprinklers installed), the Fire Marshall comes around and leaves you threatening notices if your brush looks out of control.

But I have lived in other, more dangerous areas of CA where none of this happens. A friend in Brentwood paid to have his neighbor’s brush cleared (he had to trespass), because there didn’t seem to be a Fire Marshall. And there is more wealth in his neighborhood than in Marin, so I can’t believe the problem is lack of tax dollars. Maybe it’s politics?

To Bob & Others, the answer to many of your questions is “right in your own ‘back yard’,” so to speak.

Look no further than your own County Supervisors who approve permits into the WUI and developments.

Check them out personally before you vote them in again.

These individuals act as if it is their job to FOREVER EXPAND AND GROW, as if there were an endless supply of water and other essential services………..without consequences. CA is already “in the toilet” over this concept of “forever growth” and they’ve been borrowing other counties and State’s water for over 70+ years!

Are you going to allow the same thing?

After posting my comment I have received several direct questions concerning wildfire and Colorado as it relates to Boulder County in 2022.

Boulder County is perhaps one of the better prepared counties in CO and faces some of the most problematic wildfire inputs with high sustained winds being on the top of the list. If we look into BC fire history we see the series of wildifres on the Old Stage Fires, Reservoir, Black Tiger and several others that destroyed homes or threatened large numbers of homes have brought a heightened level of awareness, even some WUI regulations. Our hats are off to Boulder County for their efforts!

What goes wrong? Is the typical question I receive and it is not necessarily what we can do for the future we are challenged with, rather it is the existing structure inventory that challenges our fire suppression forces. We have seen numerous studies, reports (ember flow tests by Jack Cohen and IBHS) but we cannot make headway on the history of unknowing, uncaring, unwilling builders, developers, planners and government bodies of the past, that high level threat problem will always exist.

During my tenure in Colorado I have seen no less than 8 public outcry’s for regulation to “decrease the threat and loss” we are still in the same position we were over 30 years ago, although we now have the Division of Fire Prevention and Control added to our response support arsenal, but this is not the answer I’m entirety.

Colorado still does not have a Fire Marshal or a State Fire Code so some of the CO issues are perpetuated and thrive behind a veil of obscurity with no mandates or dissimilar mandates that may be tailored to more benefit the builder rather than the homeowner or community.

People often point to the response forces in California and ask why we cannot match theirs, simply put, “this ain’t California” and the people of Colorado do not want to pay the level of taxes those of us who escaped CA must pay for their services.

Each community must determine their level of risk and how they will mitigate the risk without depending on a very limited amount of federal dollars. There are many communities and counties across this nation that are lured into the idea of preparing a CWPP that will garner state or federal money, the truth is that particular pot of gold is small and after extensive expenditures of time and money rarely produces even a portion of the funding needed.

As communities we have allowed, created, encouraged and not developed reality solutions to the wildfire threat, we cannot expect the feds to fix it for us, we must collectively fix the problem.

The Marshall fire was an eye-opener. Partially fueled by zoning that did not allow for home building, the “Green Belt” created a Wildland-Urban-Interface. The weather was, of course, perfect for a wildfire that day, but if the public land had been met with a brush crew and a lawnmower then the billion dollar fire could have been prevented. Hindsight is 20/20, but for me the lesson is that prevention needs to be valued more, and anywhere fuel loading exists, a wildfire can start.

There is a documentary called “Bring Your Own Brigade” and it discusses a lot of this. Insurance companies hiring private firefighters and even the residents of Paradise, CA voting down updated building codes to prevent fires after their community was destroyed, among other things. It’s a really eye opening, excellent documentary.

ABOUT: https://www.bringyourownbrigade.com/

WATCH IT: https://www.cbsnews.com/video/bring-your-own-brigade/#x

The lack of or exceedingly high insurance rates are not the focus on the WUI situation, nor has it been for a few decades. As adults that develop properties in wildfire prone areas the potential unintended consequences must be considered, one cannot depend on builders, developer, planning commissions to advise one on the potential threat, their concern is the optimum financial benefit of their product, a threatened home.

Insurance companies have been modifying risk (raising costs or eliminating those properties threatened) for the last 2 decades, the answer may be exceedingly high cost to insure in the WUI.

In the case in Boulder County (my backyard) the Marshall fire was not a new threat to the area at all, this fire soon transitioned from WUI to urban conflagration, a fire very few owners or agencies prepare for. Now for the 8th time in my tenure in CO the cry is for regulation, something that does not succeed in eliminating or significantly reduce the threat to homes in a suburban/municipal style development. And let’s be honest, an area will not achieve 100% mitigation or structure resilience, and we know patchwork mitigation does not have outcomes full community mitigation can achieve.

It isn’t just homeowners having difficulty with insurance. There are those of us that provide equipment that are having issues obtaining insurance as the insurance companies are not wanting anything to do with fire, even if your equipment is a handwash trailer sitting in a fire camp!

A few mild years and insurance companies will be drawn in to sell high dollar policies and then start competing with price. Actuarial tables don’t work for conflagrations and they only have 2 ways to make money – selling policies and denying claims. They have a short memory when a dollar is on the table. A state sponsored program will likely mess up the market and not provide suitable coverage.

In Colorado in the county where I used to live, the insurance industry is beginning to do the job that State and County government failed to do for generations. Development along and in the forested front range was and still is big business. Developers, builders, and the Real Estate industry heavily influence the lack of legislation, planning and zoning, code adoption, and regulations that would balance growth with fire risk. Don’t look to government to fix the problem, government is the problem in Colorado. They failed to address the threats and now when it is obvious that our firefighters are overmatched by the threat, only the insurance industry has sufficient influence to “encourage” correction of some of the glaring deficiencies in government.

Sorry, Bean. Blaming the State, County, or Federal Agencies for a lack of legislation, planning and zoning, code adoption, and regulations to mitigate fire risk is a far reach. If an individual wants to build in the Wildland/Urban interface they deserve anything that happens if they have done nothing themselves to mitigate their risk with Fire Wise standards. FINALLY, insurance is stepping up due to their tremendous losses and bankruptcy to only insure properties that stand a chance of not being destroyed by a wildland fire.

Scott,

Please read the International Wildland-Urban Interface Codes and tell me that government inaction is not a problem. Please note the similarity between the IWUIC codes and Fire Wise recommendations. Check on planning and zoning regulations and the building codes, or the best practice fire risk mapping as a result of previous lessons learned from many CA WUI fires and tell me that they would not have gone a long way to avoiding the development of closely spaced burnable communities like Mountain Shadows that was lost in the Waldo Canyon fire or have reduced the risk to the communities like those lost in the Marshall Fire. You don’t “build to burn” unless you are allowed to. You don’t develop and sell a fire resistant community with more expensive development and construction methods unless you have to.

Folks that move into the WUI don’t automatically come with an understanding of the hazards. Many of them came from urban areas where there was a fire hydrant on every corner, a paid full time fire and EMS department, building codes that were outcomes of urban conflagrations like the Chicago fire, and civic planning and government that stopped the urban fires of the 1900’s. The urban conflagrations of the 1900’s didn’t stop because of individuals voluntarily cleaning up their act. It stopped because of adopted new codes and regulations. Saying people should have known better is too simplistic.

Today we have a WUI problem that could be considered the counterpart of the old urban conflagration problem. To expect voluntary compliance with Fire Wise to be the answer to the WUI problem is wishful thinking. To expect developers to build fire safe communities if it requires additional costs is also wishful thinking. Follow the money. As long profit is maximized by developing burnable communities, we will continue to have today’s WUI problems. If government won’t do it, perhaps insurance costs can.

Bean…we are really on the same page. People don’t like the government telling them what they have to do. I will give you an example. The Boundary Waters Canoe Area Wilderness had a wind event in 1999 that blew down about a half million acres of trees. The Forest Service began a program of prescribed burns to remove the hazardous fuel buildup. Local residents tried a blockade to stop one of the burns. The Minnesota DNR spend years teaching Fire Wise mitigation practices to the private land owners at the end of the Gunflint Trail. FEMA even gave pumps, hose, sprinklers, and propane to run the pumps to those residence. The only thing they had to do was maintain that equipment and test it along with clearing hazardous fuel on their properties. In 2007, the Ham Lake fire ripped through that area with many homes destroyed. The homes that were lost were ones where the owner had not maintained the equipment.

To me, that says that people do not want to comply with government regulations and the only leverage is with insurance coverage.

I have no idea what your background is but 2021 was my last of 46 fire seasons. I worked many more years after retirement as a Safety Officer. As a Safety Officer, I will not put firefighters in front of WUI development if they have zero chance of protecting them. My experience is the only way to get people to make savable homes would be for insurance companies to force compliance with any government regulations and building with non-flammable materials.

Scott

BWCAW in ’99:

https://web.archive.org/web/20000816161558/http://www.fs.fed.us/fire/operations/crews/sacramento/

…and if government would continue to get out of the way of the private sector things would be much better…. Simply not the case.

Things are nuanced with blame available for everyone on this—but ultimately it’s consumption and greed. In this instance for a piece of the “wilderness” and $ for development and constant growth.

Well, what do you know. Homeowners move into the WUI and when bordering federal lands, they often have the audacity to ask the feds to “do some brush clearing and tree thinning adjacent to their property.”

I say, do your own clearing and make your home “Firewise perfect.” Go so far as to offer to enter an Agreement with the appropriate agency and do the appropriate clearing through a contract that YOU pay for.

I live near such an area and watch homes being built on two-acre lots with manzanita brush 10 foot high on two or more sides and yet they do nothing to clear the brush, thinking they now “live in the nature” and are absolutely clueless about the fire danger. And they wonder why insurance rates are sky high?

Years ago a fire marshal in central Oregon told me about a FireWise project they spearheaded. They rounded up a couple of football-fields-worth of brush and duff and yard vegetation and cleared it from the subdivision areas. He attributed the success of the program to FireWise and said it was only when they got the state fire marshal and the insurance companies to the table. … If you wanted to buy a home in Oregon you couldn’t get a mortgage on the place unless it was insured, and you couldn’t get it insured unless your fireplace/flue/woodstove was inspected/approved by the state fire marshal’s office. (This was nearly 30 years ago so details may be different now.) But the point remains … you want bank financing? You need insurance. You want insurance? You need local fire approval.

If county building codes don’t address Fire Wise suggestions, it does come down to insurance companies. Federal Wildland Firefighters cannot fully protect homes in the wildland interface…they need the help of the local fire departments.

With the hemorrhaging of the experienced/qualified retirees that the Federal Agency’s Incident Management Teams depend on, something needs to be done to keep those people around. I suggest, that the Agencies need to make available subsidized Professional Liability Insurance to the AD workforce or they will continue to hang up their boots.

I live in WUI with no federal ownership.. so I guess the county is “subsidizing insurance companies” or possible its citizens.. like subsidizing our roads, law enforcement, etc.?? Maybe that’s also called “providing services.”

It’s also interesting to think that some corporations are thought to take opportunities to “jack up” prices and “take advantage” of situations to make money.. while others.. don’t? I’m not accusing them, just noting that we seem suspicious of some corporations’ interests but not of others.

GOOD POINTS, Sharon. The subsidized costs for homeowners (and other) insurance is definitely spread out across all or most policyholders. When I lived south of Missoula an estimated 75% of the acres in the county were owned/managed by the USFS, so the fed firefighting resources covered most of the acres there — not true for you. So is the interface acreage where you live all county/state owned? Or private timberlands?

It’s mostly privately owned, ranches transitioning to housing.some county open spaces snd some leased State grasslands.

Yup, been coving this issue as well.

It’s interesting that there seems to be a revolving door between the AGs in California and the groups suing over issues like this as well.

I have long claimed private insurance would make the first move on making it difficult to live in the WUI environment. California has taken some temporary action to halt this. However, there is a new program has been instituted where as the homeowners can get a discount of their properties if they are Fire wise safe. The insurance companies then pay someone to asses these properties for discount or not. This in turn raises the companies costs and in turn expect rates to rise.

Oregon instituted a satellite base system for assessment of privately owned property for the same reasons. However, the satellite imagery that they used was not consistent with what was seen on the ground in the entire program is scrapped. Millions spent and the redo button was pushed.

Very interestingly, in the new funding bill, millions of tax dollars are allocated to depopulate areas that are in that WUI component.

From page 1551 of the spending bill:

IlI of this Act, not less than $575,000,000 should be made

available for family planning/reproductive health, including in areas where population growth threatens biodiversity or endangered species.

A huge development for these areas and an interesting use of tax payers dollars.

Great article, very interesting.

Firefighters talk about this all the time on the fireline. Our jobs as firefighters are often just subsidizing private insurance companies. Now that the federal wildland firefighting system is in a free-fall, the insurance companies are having to pay out claims, and the system is failing. Interesting economics discussion to be had there.

Exactly — people often say that big societal decisions should be governed by “the market.” Well, if these private companies are finding that selling policies to insure houses in the WUI isn’t a good business decision, they’ll stop. I doubt that will bring housing construction in WUI areas to a halt, but maybe it’ll at least lead people to think twice before building.

The federal agencies, with exception, are not responsible for structure protection on private land. Nor are most state agencies

Gotta thanks these developers and folks moving in to the WUI and Florida

Insurance, locally, up $2500 in one year

Thanks, folks

Same story with developers, encouraging homeowner to build and live in the flood plain. Nice view of the river, until the flood waters rise.