Pacific Gas and Electric has announced that it will file for Chapter 11 protection before the end of the month as it faces $30 billion in potential liability costs related to their role in starting wildfires. The company already carries a heavy debt load of more than $18 billion.

A dozen of the fires that started in Northern California around October 8, 2017 have been blamed on PG&E’s electrical equipment, according to CAL FIRE investigators, who also are looking into power line equipment failures that may have caused the Camp Fire on November 8, 2018. Over 40 people died in the Northern California fires, and 86 perished in the Camp Fire which also destroyed more than 14,000 homes.

The bankruptcy process would put a halt to more than 750 civil suits brought by thousands of homeowners and insurance companies over the wildfires allegedly caused by PG&E’s equipment, some of it 100 years old. The suits would then be resolved in a bankruptcy proceeding.

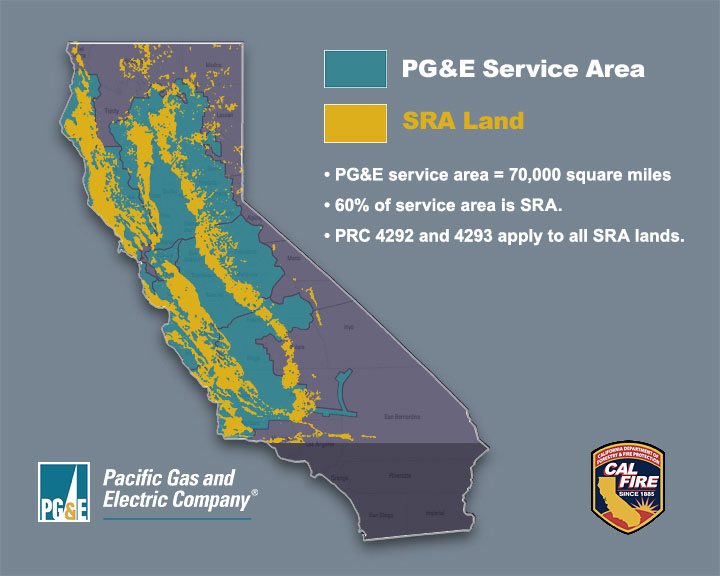

PG&E supplies power and natural gas to approximately 5.2 million households in the northern three-fourths of California. The company also declared bankruptcy in 2001 which lasted until 2004.

State law requires the corporation to notify employees at least 15 days before any bankruptcy filing. Chief Executive Geisha Williams has stepped down after serving for less than two years, the company said on Sunday.

In a brief submitted to a federal court in December, the California Attorney General said PG&E could be prosecuted for murder, manslaughter, or lesser criminal charges if investigators determine that “reckless operation” of its power equipment caused any of the wildfires in which people were killed during the previous 15 months.

Of course I don’t know how the fires started, but lets assume it was a power line….. It seems a little far reaching to blame the power company for the fire automatically. Did they do something that makes them negligent or was it a tree that was 40′ off the edge of the power line that got blown over and knocked the line to the ground? Yes the power line started the fire but mother nature put it on the ground, act of God.

If the power company continues their practice of shutting down the power during high wind events are people going to be happy with that? Especially if the wind event doesn’t happen as predicted?

I would like to see more details from specific fires.

I believe that the information given by locals who were affected was that there were numerous problems before regarding faulty power lines and equipment and the fact in some cases when there were fires reported the company didn’t shut the power off when it should have been during the high wind events. The lawyers I’m sure are gathering all the relevant information on both sides and of course media being what they are, are very anxious to get a story out ahead of their competitors. Yes. One has to wait and see what the whole story is. Meanwhile. I don’t think enough support has been given to the victims by the Federal Government. All we here is that if things don’t change in California then Government funding will be cut!

PG&E has a history of deferring maintenance to the point where equipment failure is likely. In some of these cases, PG&E had been warned of hazardous trees near power lines and did nothing to correct the faults. In others, they were relying on equipment that was pushing (or over) 100 years old that was never expected to last that long.

I think the crux of the negligence lawsuits is the this is a pattern of cutting costs that result in increased risks simply in the name of increasing shareholder value. They aren’t the only company to do this, many of the oil pipeline and refinery companies do the same thing because maintenance and replacement is expensive and cuts into their profits where the only upside is decreased risk of failure.

If this is allowed to proceed, then the folks in charge who made the actual decisions about deferring maintenance or else structure budgets so there wasn’t any money available to do the work should be held both fiscally and criminally liable.

On the other hand, if it was just a freak accident, then don’t blame them simply because they have deep pockets.

Gee this sounds like mining companies. Big pay for the CEO, upper management then declare bankruptcy rather than clean up or pay damages. PGE didn’t invest in maintenance so shareholders got bigger dividends? Nice.

Agree Martha! I think bankruptcy laws need to be changed in this country. It’s easy for these companies to wipe out debt on the backs of consumers and employees.