State Farm Insurance will discontinue coverage for 72,000 houses and apartments in California this summer. California’s largest insurer, which is based in Illinois, cites soaring costs, the increasing risk of wildfires and other catastrophes, and outdated regulations for its refusal to renew policies on 30,000 houses and 42,000 apartments, according to CBS News.

“State Farm General takes seriously our responsibility to maintain adequate claims-paying capacity for our customers and to comply with applicable financial solvency laws,” the company announced. “It is necessary to take these actions now.” California’s insurance commissioner has undertaken a yearlong overhaul of home insurance regulations aimed at calming the state’s imploding market by giving insurers more latitude to raise premiums while extracting commitments from them to extend coverage in fire-risk areas. The California Department of Insurance said State Farm will have to answer questions from regulators about this decision.

MyMotherlode reported that State Farm said it will work with Governor Gavin Newsom and Insurance Commissioner Ricardo Lara to develop reforms that better align insurance rates with risk. many California homeowners are just now discovering that their policies are being canceled — and hundreds of thousands of others are stuck with a pricey option of last resort — and for them Commissioner Lara’s efforts to fix the market can’t come soon enough.

Lara has introduced two main regulations, with more to follow. The first, unveiled last month, will streamline rate reviews. State law gives the Insurance Department the power to approve or deny insurers’ requests to raise premiums. Insurance companies complain the process holds up requested increases caused by rising climate-change risks and inflation.

The second regulation will let insurers use catastrophe modeling — which combines historical data with projected risk and losses — along with other factors when setting their premiums. California is the last state to allow this catastrophe modeling.

“We’re undertaking the state’s largest insurance reform,” Lara said earlier this month. “We can no longer look solely to the past to guide us to the future.”

This new round of cancellations accounts for just 2 percent of State Farm’s policies in the state, and the company did not indicate which regions are hit hardest, nor its criteria for selecting non-renewals.

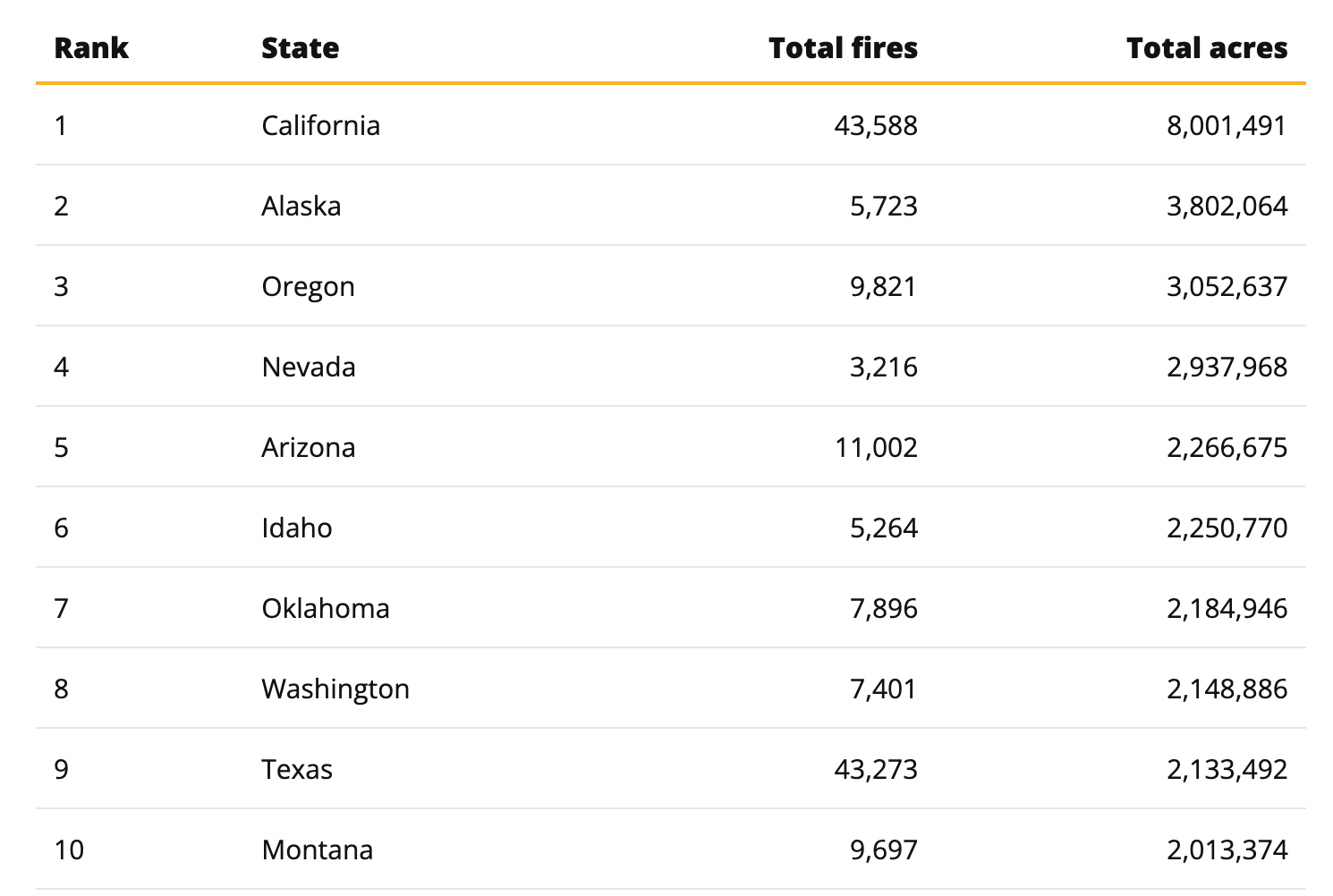

We reported last August that several major insurance companies had stopped accepting California homeowners for new policies because of growing wildfire risks. As the number of fires in the state increases and other factors escalate, insurance companies worry about the risk — and the expense.

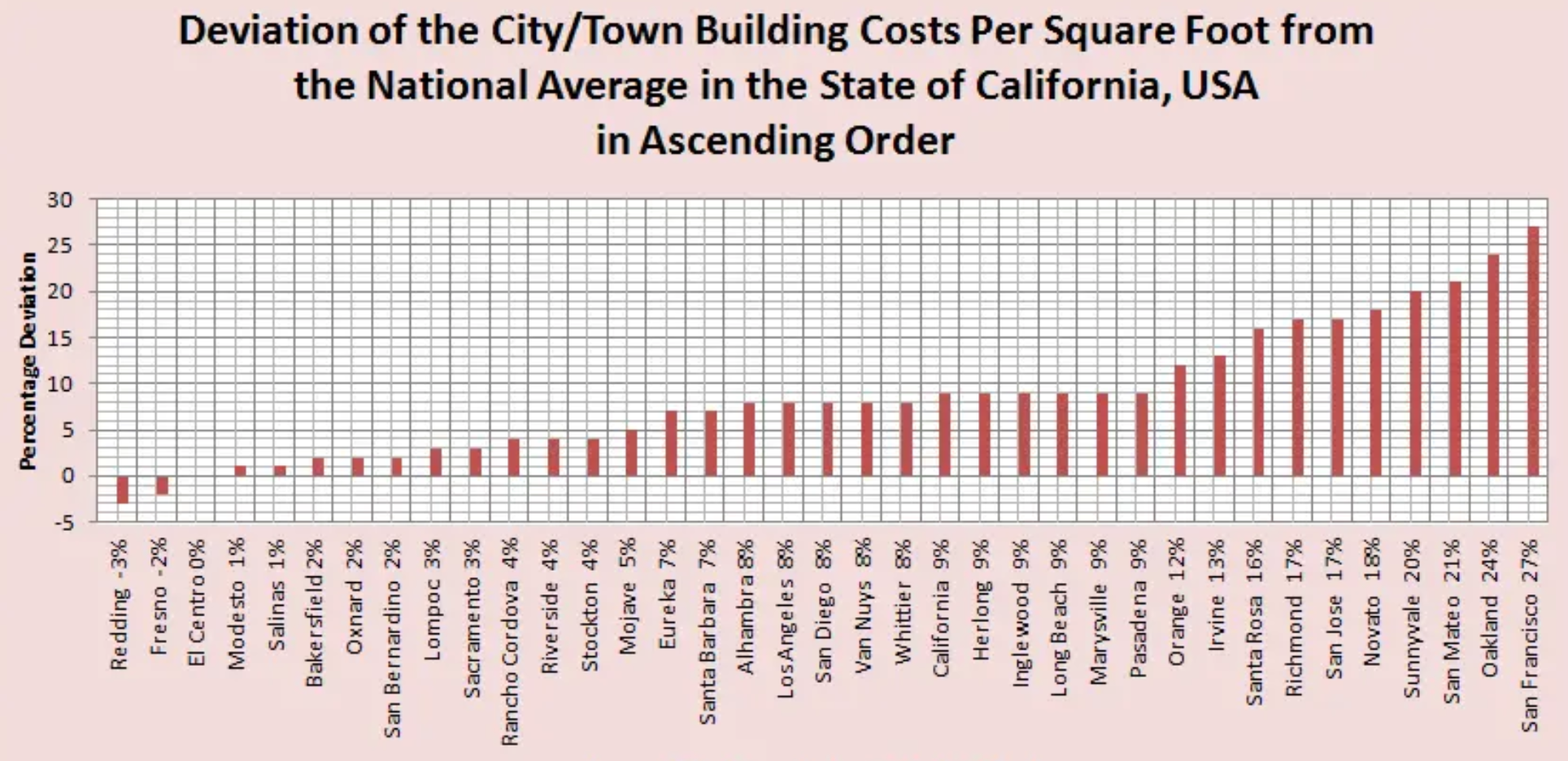

Residents in high-risk fire areas or hurricane regions need homeowners’ insurance — and lenders require it. No insurance, no home loan. More people are moving into the interface, costing insurance companies too much to repair and replace houses while battling inflation, said Janet Ruiz with the Insurance Information Institute. Two insurance giants withdrew from California’s home insurance marketplace, explaining that increasing wildfire risk and soaring construction costs have resulted in their decisions to stop writing new policies in the state. “We take seriously our responsibility to manage risk,” State Farm said. “It’s necessary to take these actions now to improve the company’s financial strength.”